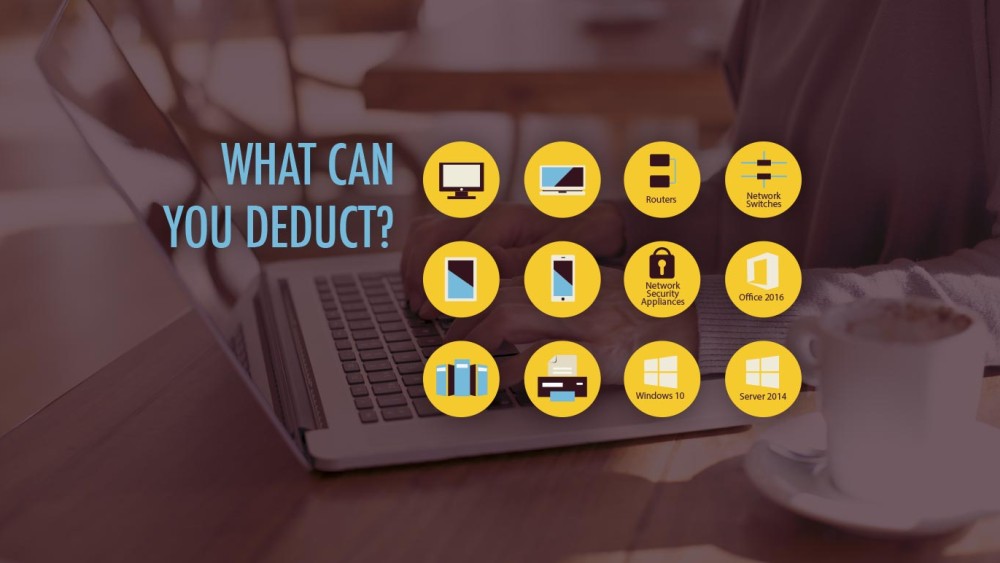

Every business needs PCs, servers, printers, network gear, data security hardware or software. Fortunately, Section 179 of the IRS tax code lets small businesses better manage their IT budgets. They can write off the entire cost of computer equipment and off-the-shelf software purchased and put in use before December 31,... read more →

Oct

26

Sep

28

When it comes to your business’s hardware and software, it pays dividends to be proactive instead of reactive. The end game is to eliminate downtime, unplanned expenses and improve productivity. However, many businesses squeeze as much life from their technology assets as possible. The downside can be unexpected expenses and... read more →

Aug

27

The dangers of gambling with unsupported & unsecure software When it comes to continued use of outdated software, are you putting your business in danger of losing vital data and information? Is your business a ticking time bomb ready to explode into a potential abyss of bankruptcy and going “out... read more →

Jul

30

Many times, businesses suffer not only the financial devastations caused by data loss, but they suffer the loss of client confidence. Both are equally devastating and determine whether a business can survive. The industries that typically suffer the most frequent and expensive breaches are healthcare, financial, pharmaceuticals, transportation and communications.... read more →